Beyond the Sticker Price: A Manufacturer\'s ROI Deep Dive into Generator Set Total Cost of Ownership

Views :

Update time : 2025-06-08

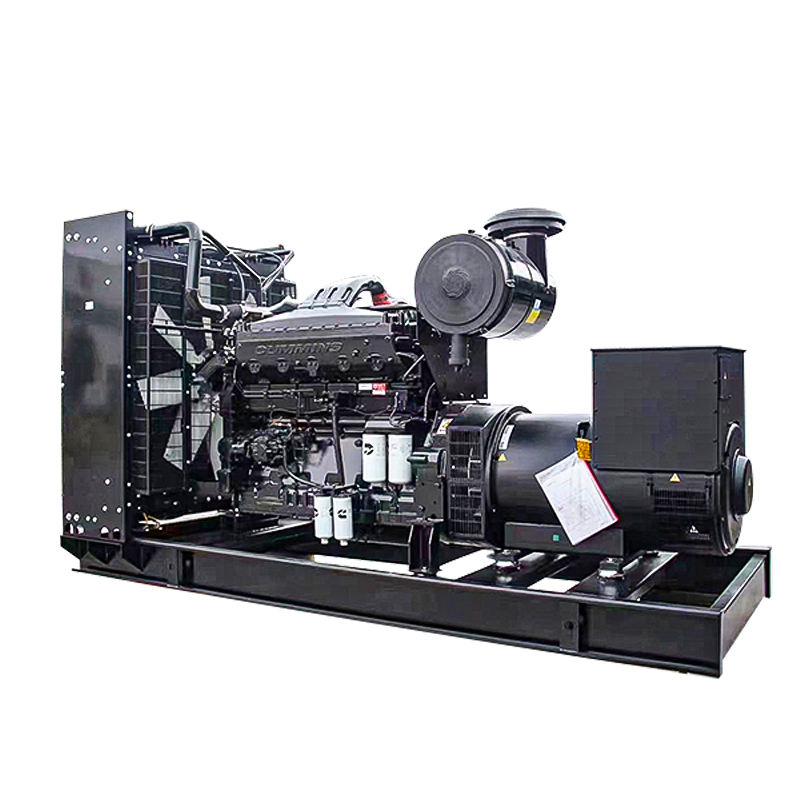

When businesses evaluate critical infrastructure investments like generator sets, the initial purchase price often dominates the conversation. To be honest, it’s a natural human tendency to focus on the immediate outlay. However, for any asset designed for long-term operation, this "sticker price" is merely the tip of the iceberg. The true financial picture, and indeed the genuine return on investment (ROI) for the end-user, lies in understanding the Total Cost of Ownership (TCO). As a manufacturer, our perspective isn't just about selling a product; it’s about delivering a complete, long-term power solution that maximizes our customers' operational efficiency and financial returns. This deep dive will explore precisely why going beyond the sticker price is paramount, and how a manufacturer’s focus on TCO directly translates into superior customer ROI.

Understanding the True Cost: Why "Beyond the Sticker Price" Matters for Generator Sets

The acquisition cost of a generator set, while significant, represents only a fraction of what a business will spend over its operational lifespan. Ignoring the subsequent costs can lead to significant financial surprises and, more importantly, a miscalculation of the actual value derived from the investment. But what truly defines the value of a generator set over its entire operational life? It’s the sum of all expenses incurred from procurement through to disposal, encompassing everything from fuel and maintenance to potential downtime and environmental compliance. For a manufacturer, understanding this holistic view is not just good business; it’s essential for building trust and delivering genuine value. We recognize that our customers are looking for reliable power, but they are also seeking a solution that contributes positively to their bottom line, not detracts from it. Interestingly enough, many of the most critical cost factors are often overlooked in initial budgetary discussions, making a manufacturer's proactive analysis of generator set Total Cost of Ownership invaluable. This comprehensive approach allows us to design, produce, and support products that offer unparalleled long-term economic benefits, demonstrating a clear path to enhanced manufacturer's ROI for our customers. The initial price tag can be deceptive. A seemingly cheaper unit might, over time, cost significantly more due to higher fuel consumption, frequent maintenance, or a shorter operational life. Conversely, a unit with a higher upfront cost might offer substantial savings in the long run, yielding a much better overall ROI. This is where the manufacturer’s expertise becomes crucial. We don't just build generator sets; we engineer them for optimal performance across their entire lifecycle, considering every potential cost factor. Our commitment extends far beyond the sales transaction, aiming to provide a power solution that continuously delivers value.Deconstructing Generator Set TCO: Key Cost Components Beyond Acquisition

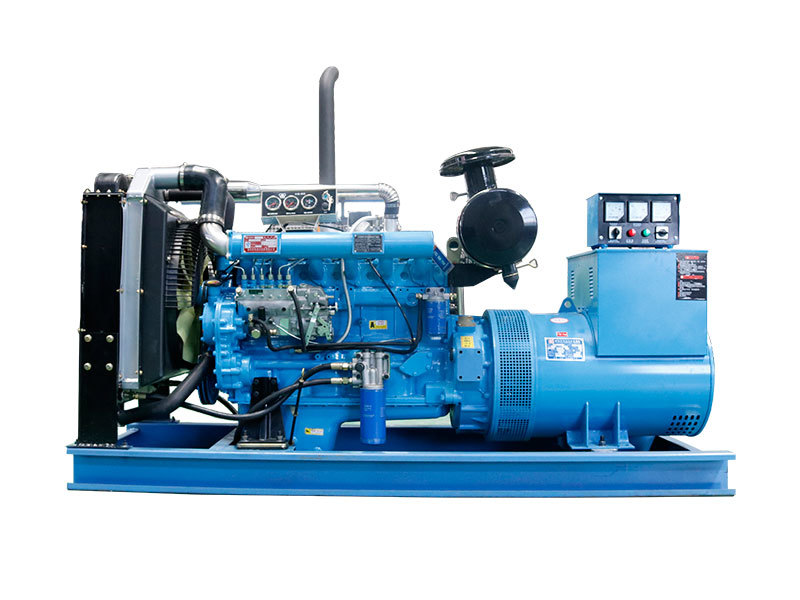

To truly grasp the concept of Total Cost of Ownership for generator sets, it's imperative to break down the various components that contribute to the overall expense. Beyond the initial purchase, these costs accumulate over years, profoundly impacting the customer's ROI. From a manufacturer's viewpoint, each of these elements presents an opportunity to innovate, optimize, and ultimately reduce the customer's financial burden. * Fuel Consumption: This is often the largest ongoing operational cost. Fuel efficiency is paramount, and even small improvements can lead to substantial savings over thousands of operating hours. Our engineering efforts are continuously focused on maximizing fuel economy without compromising power output or reliability. * Maintenance and Servicing: This includes routine preventative maintenance, unscheduled repairs, parts replacement, and labor costs. High-quality components and robust design reduce the frequency and severity of repairs. Furthermore, accessible service points and readily available parts can significantly lower maintenance expenditures. * Operational Costs: These encompass expenses related to monitoring, staffing, and managing the generator set. Remote monitoring capabilities, intuitive control systems, and automation can minimize the need for constant human oversight, thereby reducing labor costs. * Downtime Costs: Perhaps the most insidious and often underestimated cost. Unplanned outages can lead to lost production, missed deadlines, data loss, safety hazards, and damage to reputation. A reliable generator set, designed for maximum uptime, directly mitigates these potentially catastrophic costs. The manufacturer's focus on robust design and quality components is a direct investment in the customer's operational continuity. * Installation and Commissioning: While often a one-time cost, complex installations can be expensive. A manufacturer that designs for ease of installation, provides clear guidelines, and offers expert commissioning services can help streamline this phase. * Depreciation and Resale Value: The rate at which an asset loses value, and its potential resale price, are also TCO factors. High-quality, well-maintained generator sets from reputable manufacturers tend to retain their value better, offering a higher return upon eventual replacement. * Financing Costs: If the generator set is purchased through financing, the interest paid over the loan term is a direct part of the TCO. * Environmental Compliance and Disposal: Adhering to emissions standards, proper waste disposal, and eventual decommissioning costs are increasingly relevant factors in TCO, particularly as regulations evolve.

The Manufacturer's Role in Optimizing Customer ROI Through TCO Management

Our commitment as a manufacturer extends far beyond simply selling a generator set. We see ourselves as a strategic partner in our customers' success, and a core part of that partnership involves actively helping them optimize their Total Cost of Ownership, thereby maximizing their ROI. In my experience, this is where a true partnership begins – when a manufacturer proactively addresses the long-term financial implications for the customer. How do we achieve this? It starts with design and engineering. We invest heavily in research and development to produce generator sets that are inherently more efficient and durable. This means: * Designing for Fuel Efficiency: Implementing advanced engine technologies, optimized combustion processes, and efficient power management systems to reduce fuel consumption, which, as noted, is a major TCO component. * Enhancing Durability and Reliability: Using high-quality components and robust construction techniques to extend the operational life of the unit and minimize the need for unscheduled repairs. This directly reduces maintenance costs and, critically, downtime. * Facilitating Easier Maintenance: Engineering designs that allow for quicker, simpler routine maintenance procedures, reducing labor time and associated costs. This includes features like easily accessible service points and modular designs. * Implementing Advanced Monitoring and Diagnostics: Integrating telematics and remote monitoring systems that provide real-time data on performance, fuel levels, and potential issues. This allows for predictive maintenance, addressing problems before they lead to costly breakdowns and significant downtime. Such systems are pivotal in managing generator set Total Cost of Ownership. * Providing Comprehensive Support and Training: Offering extensive training for customer personnel on operation and basic maintenance, coupled with readily available technical support and a robust network for parts and service. This empowers customers to manage their assets more effectively and reduces reliance on expensive third-party interventions. * Optimizing Parts Availability and Pricing: Ensuring that genuine replacement parts are readily available and competitively priced. This prevents customers from resorting to inferior aftermarket parts that could compromise performance and lead to higher long-term costs. By focusing on these areas, we directly influence the customer's operational expenses, transforming what might initially appear as a higher upfront investment into a significantly lower Total Cost of Ownership over the asset's lifespan. This proactive approach to TCO management is a cornerstone of our value proposition, ensuring our customers realize a superior manufacturer's ROI on their generator set investment.Quantifying the Return: Calculating ROI from TCO Savings

For businesses, the ultimate measure of any investment is its return. When discussing Total Cost of Ownership for generator sets, it's not enough to simply list the cost components; we must also demonstrate how optimizing TCO directly translates into a quantifiable ROI for the customer. How can a manufacturer effectively demonstrate this long-term value proposition? It involves illustrating the financial benefits of choosing a solution engineered for lower TCO, even if its initial sticker price is higher. Consider a scenario: Company A purchases a generator set with a lower initial cost but higher fuel consumption and more frequent maintenance requirements. Company B invests in a generator set from our company, which has a slightly higher upfront cost but boasts superior fuel efficiency, extended service intervals, and advanced predictive maintenance capabilities. Let's put some hypothetical numbers to it: * Initial Purchase Price: * Company A's unit: $100,000 * Company B's unit (ours): $120,000 * Annual Fuel Costs (assuming 2,000 operating hours): * Company A's unit (less efficient): $50,000 * Company B's unit (more efficient): $40,000 (a $10,000 annual saving) * Annual Maintenance Costs (parts & labor): * Company A's unit (more frequent/complex): $15,000 * Company B's unit (extended intervals/predictive maintenance): $10,000 (a $5,000 annual saving) * Downtime Costs (estimated annual impact): * Company A's unit (higher risk): $20,000 * Company B's unit (higher reliability): $5,000 (a $15,000 annual saving) Over just one year, Company B saves $10,000 (fuel) + $5,000 (maintenance) + $15,000 (downtime) = $30,000. While Company B paid an extra $20,000 upfront, they recoup that difference and gain an additional $10,000 in savings within the first year alone. Over a typical 10-year lifespan, these annual savings compound dramatically, leading to hundreds of thousands of dollars in total savings. This simplified example highlights how a higher initial investment in a quality, TCO-optimized generator set can lead to a rapid payback period and a significantly higher manufacturer's ROI for the customer. Metrics like Payback Period (how long it takes for savings to offset the initial investment), Net Present Value (NPV), and Internal Rate of Return (IRR) can be used to formally quantify these benefits. Many experts agree that shifting focus from initial price to total cost of ownership is the hallmark of a mature, customer-centric business. Our role is to provide the data and analysis that empower customers to make informed decisions that benefit their long-term financial health, solidifying our position as a preferred partner.

Strategic Advantages: How a TCO-Centric Approach Elevates a Manufacturer's Offering

Adopting a deep-seated focus on Total Cost of Ownership is more than just a sales tactic; it's a fundamental shift in business strategy that provides significant competitive advantages for a manufacturer. By consistently demonstrating how our generator sets deliver superior ROI over their lifespan, we elevate our offering beyond mere product specifications and price points. This approach allows us to differentiate ourselves in a crowded market and forge stronger, more enduring relationships with our customers. Firstly, it fosters competitive differentiation. In an industry where many competitors might still lead with initial price, our ability to articulate and prove the long-term financial benefits of a lower TCO positions us uniquely. We're not just selling a machine; we're selling a solution that saves money, reduces risk, and enhances operational efficiency over time. This value proposition resonates deeply with financially savvy decision-makers who look beyond immediate expenses. Secondly, it builds customer trust and loyalty. When customers see that a manufacturer is genuinely invested in their long-term financial success, it cultivates a level of trust that is difficult to break. By providing transparent TCO analyses and delivering on the promise of lower operational costs, we become a trusted advisor rather than just a vendor. This leads to repeat business, positive referrals, and a strong brand reputation. Our focus on minimizing generator set Total Cost of Ownership for our clients directly impacts their perception of our brand's value. Thirdly, a TCO-centric approach encourages a shift from transactional sales to consultative partnerships. Instead of simply quoting prices, our sales and engineering teams engage in deeper conversations about operational needs, future growth, and financial objectives. This allows us to tailor solutions that truly meet specific customer requirements, often revealing opportunities for savings that the customer might not have initially considered. This consultative approach strengthens the relationship and ensures that our solutions are perfectly aligned with the customer's strategic goals. Finally, focusing on TCO drives internal innovation. To continually reduce the Total Cost of Ownership for our customers, we are constantly challenged to innovate in areas like fuel efficiency, component durability, predictive maintenance technologies, and ease of serviceability. This continuous improvement cycle ensures that our products remain at the forefront of the industry, pushing the boundaries of what's possible in power generation and solidifying our position as a leader in delivering superior manufacturer's ROI for our customers. It's a virtuous cycle where customer benefit drives our own growth and advancement.Looking Ahead: The Future of Generator Set TCO and Manufacturer Innovation

The landscape of power generation is constantly evolving, and with it, the factors influencing Total Cost of Ownership for generator sets. As a forward-thinking manufacturer, we are not only focused on optimizing current TCO parameters but also anticipating future trends and innovating to meet them. This proactive stance ensures that our customers continue to realize exceptional ROI from their investments in our power solutions. One significant area of evolution is the integration of advanced technologies. The rise of the Industrial Internet of Things (IIoT), artificial intelligence (AI), and machine learning is revolutionizing how generator sets are monitored, maintained, and operated. Predictive analytics, powered by AI, can now analyze vast amounts of operational data to anticipate potential failures before they occur, scheduling maintenance proactively and dramatically reducing unplanned downtime – a major contributor to TCO. This shift from reactive to predictive maintenance is a game-changer for generator set Total Cost of Ownership. Furthermore, the push towards sustainability and alternative energy sources is reshaping the TCO equation. While traditional diesel generator sets remain vital, hybrid systems combining generators with renewable energy sources (like solar or wind) and battery storage are gaining traction. These systems can significantly reduce fuel consumption and emissions, offering a lower environmental footprint and, in many cases, a lower long-term TCO due to reduced fuel costs and potential carbon credits. Manufacturers are increasingly focusing on developing multi-fuel capabilities and integrating these diverse energy sources seamlessly. Another critical aspect is the increasing emphasis on regulatory compliance and environmental impact. Stricter emissions standards and disposal regulations mean that the environmental costs associated with a generator set are becoming more prominent in the TCO calculation. Manufacturers that design products with lower emissions and easier, more environmentally friendly disposal processes will offer a distinct advantage, contributing to a lower overall TCO for the customer. In conclusion, the role of a generator set manufacturer is transforming. We are no longer just suppliers of equipment; we are becoming comprehensive energy solution providers, deeply invested in the long-term success and financial health of our customers. By relentlessly focusing on reducing the Total Cost of Ownership through innovation, quality, and comprehensive support, we ensure that our customers not only get a reliable power source but also a significant and sustainable manufacturer's ROI that extends far beyond the sticker price. This commitment to value is what truly defines our partnership with industries worldwide.For more detailed information, please visit our official website:Generator set TCO

About the author: Dr. Evelyn Reed is a seasoned expert in industrial power solutions with over two decades of experience in generator set manufacturing and energy systems optimization. Holding a Ph.D. in Mechanical Engineering, her work focuses on the intersection of advanced technology and economic efficiency, particularly in demonstrating the long-term ROI of capital equipment through meticulous TCO analysis. She is passionate about helping businesses make informed decisions that drive sustainable growth and operational excellence.

Related News

2025 Power Grid Alert: How Facility Engi

Dec .11.2025

Discover actionable strategies for facility engine...

Top Diesel Genset Manufacturers in China

Dec .09.2025

Discover the top diesel genset manufacturers in Ch...

Genset 101: The Ultimate Guide to Unders

Dec .09.2025

Genset 101: The Ultimate Guide to Understanding, C...

Beyond the Box: How to Find a Reliable G

Dec .03.2025

Searching for a reliable generator set manufacture...